DeFi is a growing trend in the cryptocurrency industry that aims to make traditional financial services like lending, borrowing, trading, and payments less dependent on a central authority. Most of the time, centralized institutions like banks and financial companies provide these services. These institutions can control and regulate the flow of money in an economy.

DeFi wants to offer the same kinds of financial services by using smart contracts and blockchain technology on decentralized networks of computers to do the work.

In the past few years, the DeFi movement has gained a lot of support. Several things have led to this growth, such as more people using cryptocurrencies in everyday life, making DeFi platforms easier to use, and looking for alternative financial systems after the COVID-19 pandemic.

As DeFi continues to evolve and mature, it is expected to significantly impact the traditional financial industry and how we think about money and financial transactions.

This article will share my top 20 favorite decentralized finance (DeFi) projects. These projects have caught my attention due to their innovative use of blockchain technology to revolutionize how we think about financial services. From decentralized exchanges and lending platforms to stablecoins and prediction markets, these DeFi projects are paving the way for a more open, transparent, and inclusive financial system. Stay tuned to learn more about these exciting projects and how they are shaping the future of finance.

Evaluation criteria for choosing DeFi projects

When deciding how good a DeFi project is, you must consider several things to make the right choice. Here are four key factors to consider:

- Team: The team behind a DeFi project can significantly impact its success. Look for projects with strong leadership, diverse backgrounds, and a track record of achievement in the space.

- Technology: DeFi projects often have complicated technical systems, so studying the technology behind them is essential. Look for projects that use proven technologies, have robust security measures and are transparent about their code.

- Adoption: For DeFi projects to work, there needs to be a network effect, so it’s essential to consider how widely a project has been used. Look for projects with solid communities, high levels of liquidity, and active development.

- Regulatory environment: The way DeFi projects are regulated differs from place to place. It’s important to consider how changes in regulations affect a project’s work and to choose projects that follow the laws and rules.

Overall, it’s essential to do your due diligence when evaluating DeFi projects and consider various factors to make informed investment decisions.

Top 20 DeFi projects to consider investing in 2023

Here are my top 20 DeFi projects to consider investing in 2023.

But before you jump in, this is by no means financial or investment advice. I’m not a financial advisor. Please note that investing in cryptocurrencies is highly speculative and carries significant risk. Doing your research and assessing the risks carefully before making investment decisions is essential.

Ethereum

Most decentralized finance (DeFi) projects have been built on Ethereum, making it a popular choice for DeFi development. In a sense, Ethereum is a foundational platform for DeFi projects, but it is not itself a DeFi project. And since Defi projects run on Ethereum, the demand for Ethereum will continue to increase. Hence, it is my favourite Defi project in which to invest.

MakerDAO

MakerDAO allows users to take out loans and earn interest on their collateral. Here are a few reasons why MakerDAO is considered a good DeFi project:

- Stablecoin: MakerDAO is best known for its stablecoin, called DAI, which is pegged to the US dollar and designed to maintain a stable value. This makes DAI a helpful tool for hedging against cryptocurrency price volatility and a good store of value.

- Transparency: MakerDAO is open-source, meaning anyone can view and audit the code. This increases transparency and helps to build trust among users.

- MakerDAO has a solid and active community of developers, users, and supporters who help move the project forward and ensure it will be around for a long time.

- MakerDAO is one of the most popular DeFi platforms, and there are a lot of loans and stablecoins in circulation. This strong adoption is a good sign for the project’s prospects.

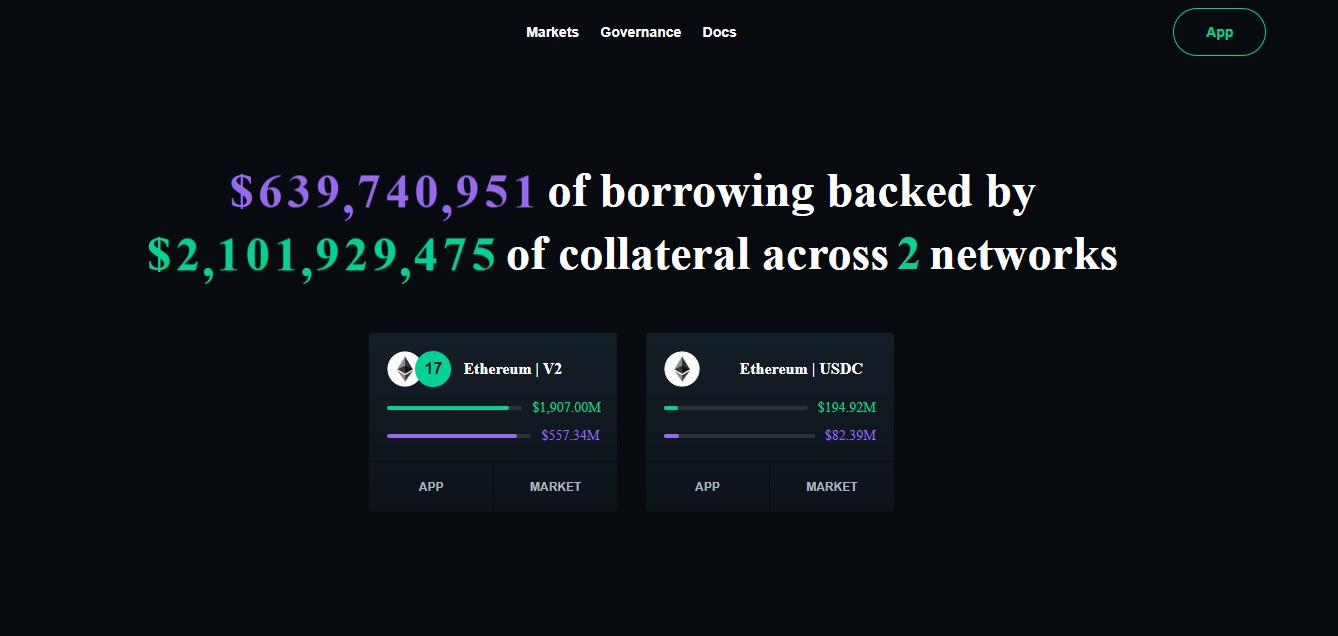

Compound

One of the main benefits of Compound is that it allows users to earn interest on their deposits without having to trust a centralized entity with their funds.

Compound has another benefit in that it lets users borrow cryptocurrency using the assets they have deposited as collateral. This can help traders who want to increase the size of their positions or people who need cash but don’t want to sell their cryptocurrency.

Compound also has a transparent and automated interest rate mechanism. This mechanism changes each asset’s interest rates based on real-time supply and demand. This helps ensure that people can get good returns on their deposits and that people who need money can get it at reasonable rates.

Overall, Compound is a well-known and widely used DeFi protocol that has helped the decentralized finance ecosystem grow. It is a good choice for anyone who wants to earn interest on their cryptocurrency deposits or borrow cryptocurrency in a decentralized way.

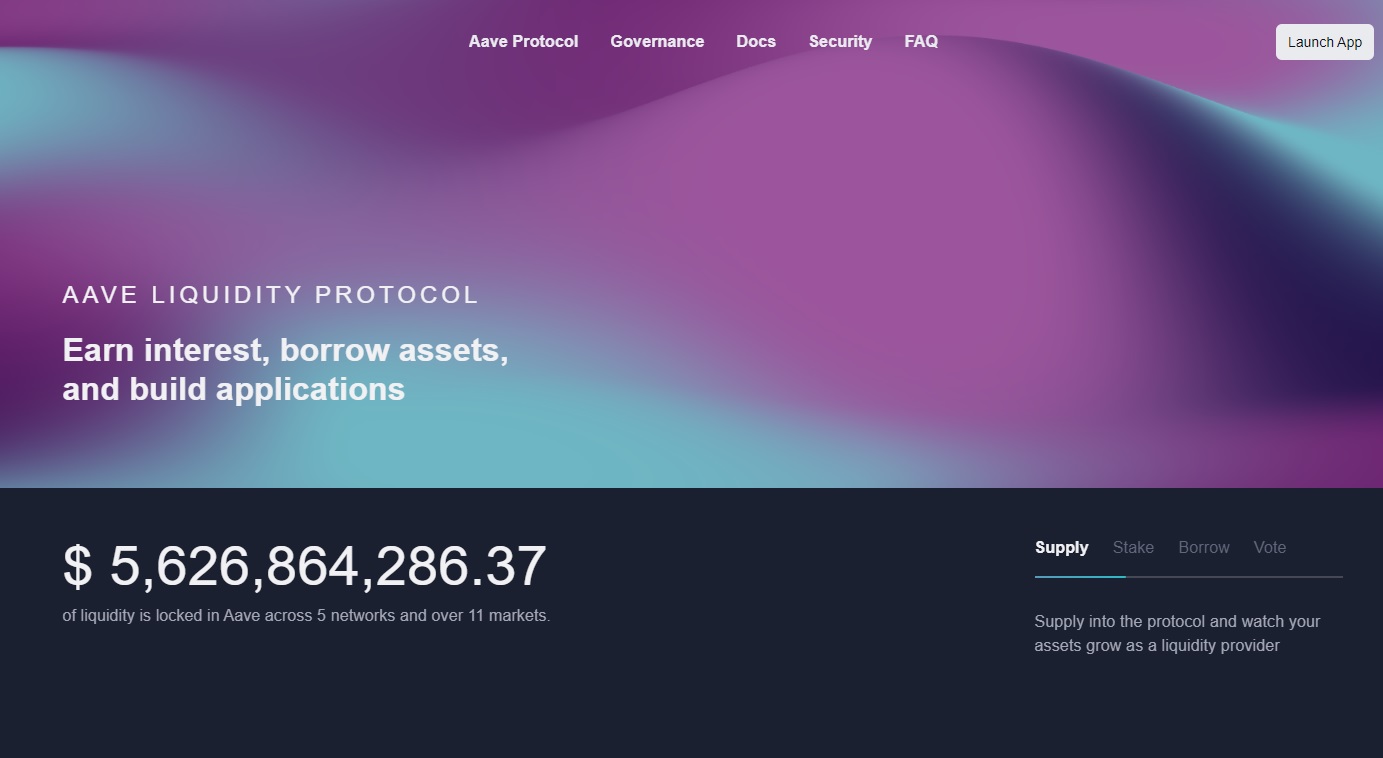

Aave

Aave is a decentralized finance (DeFi) platform that allows users to borrow and lend cryptocurrencies. It is considered a good DeFi project because it has several features that make it attractive to users.

One of the essential things about Aave is that it can offer loans with variable interest rates. This means that borrowers can choose the interest rate they are willing to pay, and lenders can choose the rate they are willing to lend. This allows for a more flexible and efficient market for loans.

Aave also has several innovative features that make it stand out from other DeFi platforms. For example, it allows users to take out “flash loans,” short-term, high-risk loans that can be used for arbitrage and other trading strategies. It also has a “stability module” that helps keep the platform stable by automatically changing interest rates based on how the market is doing.

Overall, Aave is seen as a solid and well-respected DeFi project because of its new features, strong track record, and commitment to security and transparency.

Uniswap

Uniswap allows users to trade cryptocurrency tokens directly without needing a centralized exchange. It is considered a good DEX for the following reasons:

- Automated market-making: Uniswap uses a smart contract to facilitate trades between users. The smart contract automatically makes sure the exchange has enough tokens to trade by keeping track of the balance of both tokens. This makes it easy for users to buy and sell tokens without worrying about finding a matching counterparty.

- Low fees: Uniswap charges a small transaction fee, but it is significantly lower than the fees charged by many centralized exchanges. This makes it an attractive option for trading small amounts of cryptocurrency.

- Easy to use: Uniswap has a simple and user-friendly interface, making it easy for even novice cryptocurrency users to trade on the platform.

- Wide range of tokens: Uniswap is a good platform for people who want to trade a wide range of digital assets because it supports a wide range of Ethereum-based tokens, such as ERC-20 and ERC-721 tokens.

Band Protocol

The Band Protocol is a project for decentralized finance (DeFi) that aims to give decentralized applications (DApps) a safe and scalable way to store and share data. The Band Protocol uses a decentralized oracle network to give smart contracts on-blockchain data that can be checked. This lets DApps access off-chain data in a safe and trustless way. The project is built on the Cosmos blockchain and is meant to be a decentralized alternative to traditional centralized oracle systems.

There are a few reasons why Band Protocol might be considered a good DeFi project:

- Decentralized oracles: One of the essential parts of the Band Protocol is its network of decentralized oracles, which lets smart contracts access off-chain data in a safe and trustless way. This is important because it lets DApps use data from outside the blockchain, which can be helpful in many situations.

- Scalability: The Band Protocol is built on top of the Cosmos blockchain, which is known for its high transaction throughput and scalability. The Protocol can handle large data requests without slowing down or becoming congested.

- Security: Band Protocol is designed to be a safe platform with multiple layers of security to protect against attacks. The platform’s decentralized nature also helps reduce the risk of censorship or tampering.

- Interoperability: The Band Protocol is made to work with other blockchains, so DApps can use it on multiple platforms as a data infrastructure.

Overall, Band Protocol’s decentralized Oracle network, scalability, security, and interoperability make it a strong contender in the DeFi space.

Synthetix

Synthetix is a DeFi platform that allows users to trade synthetic assets, which are digital assets that track the value of real-world assets. The platform uses a system of smart contracts to facilitate the creation and trading of assets, called “Synths.” Synthetix offers various Synths that track the value of assets such as commodities, currencies, and stocks.

There are several reasons why Synthetix is considered a good DeFi project:

- Wide range of synthetic assets: Synthetix offers a wide variety of Synths, allowing users to gain exposure to diverse assets without actually owning them. For example, a user who is bullish on the price of gold but does not want to purchase physical gold can buy a Synth that tracks the price of gold. By offering a wide variety of Synths, Synthetix allows users to gain exposure to a diverse range of assets they may not otherwise have access to. Synthetix lets people bet on the prices of different assets without owning them. This can be useful for hedging against price movements or taking advantage of price trends.

- Liquidity: Synthetix has a large and active user base, so there is usually a good amount of liquidity on the platform. This makes it easy for users to buy and sell Synths without worrying about finding a matching counterparty.

- Low fees: Synthetix charges relatively low fees for its services, which makes it an attractive option for users looking to trade synthetic assets.

- Community involvement: Synthetix has a solid and active community of developers and users, which helps drive the platform’s innovation and development.

0x

0x is a decentralized exchange (DEX) protocol that allows users to trade Ethereum-based assets in a decentralized manner. It is considered a good DEX for the following reasons:

- Off-chain order relay: 0x uses an off-chain order relay system to facilitate user trades. This allows for faster and cheaper trades, as most of the trade process is handled on the Ethereum blockchain.

- Wide range of assets: 0x is an attractive platform for users looking to trade a wide range of digital assets.

- Customizable: Because 0x is an open protocol, it can be changed and added to other programs. This makes it a flexible and versatile DEX platform.

- Strong developer community: 0x has a solid and active community of developers, which helps to drive innovation and development on the platform.

0x is a good DEX because it is decentralized, supports a wide range of assets, and has a strong community of developers.

Serum

The serum is a decentralized exchange (DEX) built on the Solana blockchain. It aims to make trading cryptocurrencies quick and cheap. The Solana blockchain, known for its fast transactions and low fees, makes trading fast and easy. It also has a decentralized governance model that lets users use the SRM token to vote on changes to the platform. The serum is meant to be a decentralized alternative to traditional centralized exchanges that give users more control over their assets and trading activities.

Balancer

Balancer is a decentralized exchange (DEX) and automated market maker (AMM) built on the Ethereum blockchain. It is considered a good DEX because it has several features that make it attractive to users:

- Automated market-making: By keeping a balance of both tokens being traded, the smart contract automatically makes sure the exchange has enough tokens to trade. This makes it easy for users to buy and sell tokens without worrying about finding a matching counterparty.

- Low fees: Balancer charges a small transaction fee, but it is significantly lower than the fees charged by many centralized exchanges. This makes it an attractive option for trading small amounts of cryptocurrency.

- Customizable pools: Balancer allows users to create custom pools of tokens, which can then be traded on the platform. This allows users to create pools of tokens that meet their interests.

- Strong developer community: Balancer has a solid and active community of developers, which helps to drive innovation and development on the platform.

The Balancer is considered a good DEX because it is decentralized, can make markets automatically, and has a strong community of developers.

Chainlink

While Chainlink is not a decentralized finance (DeFi) project, it is often used as a critical infrastructure component in DeFi applications.

Chainlink connects smart contracts to external data sources and APIs, so they can access real-world data like price feeds, weather data, and other off-chain information. Smart contracts in DeFi applications can use data from the real world to make better, more data-driven decisions.

Overall, Chainlink is a critical infrastructure project in the DeFi space because it lets DeFi applications access reliable and secure off-chain data, which is vital for many DeFi use cases. This means the price of Chainlink will always be on an upward trajectory as more and more DeFi projects depend on it.

UMA

UMA, which stands for “Universal Market Access,” is a project for decentralized finance (DeFi) that aims to give people a place to make and trade “synthetic assets.” Synthetic assets are digital assets that are made to follow the price of a tangible asset, like a stock or commodity. UMA creates and manages these assets with the help of smart contracts and a decentralized oracle network. This lets users gain exposure to a wide range of assets without owning them. UMA is built on top of the Ethereum blockchain and is meant to be a decentralized alternative to traditional financial instruments like futures and options.

Bancor

Bancor is considered a good DEX because it has several features that make it attractive to users:

- Automated market-making: Bancor uses a smart contract to facilitate trades between users. By keeping a balance of both tokens being traded, the smart contract automatically makes sure the exchange has enough tokens to trade. This makes it easy for users to buy and sell tokens without worrying about finding a matching counterparty.

- Low fees: Bancor charges a small transaction fee, but it is significantly lower than the fees charged by many centralized exchanges. This makes it an attractive option for trading small amounts of cryptocurrency.

- Wide range of tokens: Bancor works with a wide range of tokens based on Ethereum, such as ERC-20 and ERC-721 tokens. This makes it an attractive platform for users who want to trade a wide range of digital assets.

- User-friendly interface: Bancor has a simple and user-friendly interface, making it easy for even novice cryptocurrency users to trade on the platform.

Overall, Bancor is considered a good DEX because it is decentralized, can make markets automatically, and has an easy-to-use interface.

Kyber Network

Kyber Network is a decentralized exchange (DEX) and liquidity protocol built on the Ethereum blockchain. It is considered a good DEX because it has several features that make it attractive to users:

- Wide range of assets: Kyber Network supports a wide range of Ethereum-based assets, including ERC-20 and ERC-721 tokens.

- Instant trades: Kyber Network allows users to make trades almost instantly, as the platform can match buyers and sellers in real time. This makes it a convenient option for users looking to trade quickly.

- Strong liquidity: Kyber Network has a large and active user base, which means there is usually a good amount of liquidity on the platform. This makes it easy for users to buy and sell tokens without worrying about finding a matching counterparty.

- Integration with other platforms: Kyber Network has been built into several popular cryptocurrency wallets and apps, making it easy for users to access and use.

Overall, Kyber Network is considered a good DEX because it is decentralized, supports a wide range of assets, has strong liquidity, and works well with other platforms.

Curve

The Curve is a decentralized exchange (DEX) that focuses on trading stablecoins; cryptocurrency tokens pegged to the value of a real-world asset such as the US dollar. It is considered a good DEX because it has several features that make it attractive to users:

- Low fees: Curve charges a small transaction fee, but it is significantly lower than the fees charged by many centralized exchanges. This makes it an attractive option for trading small amounts of cryptocurrency.

- Strong liquidity: Curve has a large and active user base, which means there is usually a good amount of liquidity on the platform.

- Wide range of stablecoins: Curve works with several stablecoins, including popular ones like USDC, DAI, and TUSD. This makes it an attractive platform for users looking to trade stablecoins.

- Efficient trading: Curve’s trades are made possible by an automated market maker (AMM) model, which makes trading quick and cheap.

Overall, Curve is thought to be a good DEX because it is decentralized, has low fees, has good liquidity, and makes it easy to trade.

tBTC

tBTC is a DeFi project because it lets users use Bitcoin in Ethereum-based DeFi protocols and applications. tBTC enables users to access DeFi services with Bitcoin by wrapping it in an ERC-20 compatible wrapper, which was previously impossible due to differences between the Bitcoin and Ethereum networks. This makes it easier for users to access DeFi services and participate in the growing DeFi ecosystem using the world’s most widely-used cryptocurrency.

Ren

Ren is a decentralized finance (DeFi) protocol that allows users to trade cryptocurrency assets across different blockchains in a decentralized manner. Some of its features that make it attractive to users are:

- Cross-chain compatibility: Bitcoin, Ethereum, and other blockchains can all be used with Ren to trade assets. This makes it an attractive platform for those who want to trade a wide range of digital assets.

- Strong liquidity: Ren has a large and active user base, which means there is usually a good amount of liquidity on the platform.

- Low fees: Ren charges a small transaction fee, which is significantly lower than the fees charged by many centralized exchanges.

Ren is seen as a good DeFi project because it is decentralized, has strong liquidity, and lets users trade assets across blockchains.

Nexo

Nexo is a platform for decentralized finance (DeFi) that lets people lend and borrow digital assets. It has several features that make it attractive to users:

- Wide range of assets: Nexo supports various cryptocurrency assets, including Bitcoin, Ethereum, and others. This makes it an attractive platform for users looking to lend or borrow a wide range of digital assets.

- High security: Nexo uses a decentralized network of validators to ensure the security and integrity of the platform. It also holds user assets in cold storage to enhance security further.

- Reasonable interest rates: Both lenders and borrowers can get reasonable interest rates on Nexo, which makes it a good choice for people who want to make the most of their money.

- User-friendly interface: Nexo has a simple and user-friendly interface, making it easy for even novice cryptocurrency users to use the platform.

Overall, Nexo is considered a good DeFi project because it is decentralized, has a wide range of assets, and offers attractive interest rates and a user-friendly interface.

Nexus Mutual

Users can buy insurance for their smart contracts and decentralized applications (DApps) through Nexus Mutual. Nexus Mutual is considered a good DeFi project because it has several features that make it attractive to users:

- Flexibility: Nexus Mutual allows users to customize their insurance coverage based on their specific needs and risks. This gives users control over the type and amount of coverage they purchase.

- Nexus Mutual is a community-driven platform, which means that users can take part in making decisions about the platform by holding and staking NXM tokens.

- Low fees: Nexus Mutual charges relatively low fees for its insurance coverage, making it an affordable option for users.

- Security: Nexus Mutual uses a decentralized network of validators to ensure the security and integrity of the platform.

Nexus Mutual is considered a good DeFi project because it is decentralized, flexible, has a community-driven model, and has low fees.

Yearn.finance

For a few reasons, yearn.finance has gained a reputation as a good DeFi project. It is designed to be user-friendly and to make it easy for users to access and take advantage of various financial products and services. Additionally, Yearn.finance has a strong focus on risk management, which helps to ensure that users’ investments are as secure as possible. Finally, the platform has a team of experienced developers and financial experts who are constantly working to improve it and introduce new products and services that meet users’ needs.

Loopring

Loopring also utilizes ring mining, which allows it to process trades quickly and cheaply. Additionally, the Protocol is designed to be scalable, so it can handle a large volume of trades without experiencing any slowdown or disruption. Overall, Loopring’s combination of security, efficiency, and scalability makes it a strong choice for users looking to trade cryptocurrency assets in the DeFi space.

InstaDApp

InstaDapp enables users to access and interact with various DeFi services in a user-friendly and convenient manner. It bridges different DeFi protocols, making it easy for users to switch between services and get the best rates and terms. InstaDApp also offers a range of tools and features to help users manage and optimize their DeFi portfolio, including automatic rebalancing and yield farming recommendations. InstaDApp’s focus on user experience and portfolio management makes it a strong choice for users looking to start with DeFi.

Bzx

Bzx is a decentralized lending and margin trading platform that offers a range of features that make it attractive to users. One key feature is its low fees, which make it an affordable option for users looking to borrow or lend cryptocurrency assets. Bzx also pays a lot of attention to security. Smart contracts and other measures are used to protect user assets. Additionally, the platform offers a high level of liquidity, which makes it easy for users to access the funds they need when they need them. Finally, Bzx has a user-friendly interface that makes it easy for users to navigate and use the platform, even if they are new to DeFi.

OpenSea

OpenSea is not necessarily a DeFi project in the traditional sense, as it does not offer financial products or services such as lending or margin trading. But it is often thought of as part of the DeFi space because it uses blockchain technology and smart contracts to make peer-to-peer transactions safe and clear. Also, many DeFi projects, like yield farming protocols, use NFTs to represent different assets or reward users. This means that the DeFi space and the NFT space often overlap.

MCDEX

MCDEX (short for “Multi-Collateral Dai Exchange”) allows users to trade DAI, a stablecoin pegged to the US dollar, and other ERC-20 tokens. MCDEX is a DeFi project built on Ethereum that lets users trade and borrow money without a bank. DeFi projects like MCDEX aim to provide financial services that are open, transparent, and accessible to everyone without the need for intermediaries like banks or other financial institutions.

dYdX

dYdX’s combination of non-custodial, decentralized, lending and borrowing, and user-friendly features make it a solid DeFi project that is well-regarded by many in the community.

Risks and considerations for investing in DeFi projects

Like any investment, investing in DeFi projects carries some level of risk. Here are a few key risks and considerations to be aware of:

- Volatility: The value of DeFi projects can be highly volatile and fluctuate significantly over short periods. This means that the value of your investment may rise or fall dramatically, and you should be prepared for the possibility of significant losses.

- Lack of regulation: Many DeFi projects operate in a largely unregulated environment, which can make them more vulnerable to fraud and other types of misconduct. It’s important to carefully evaluate the trustworthiness of a project and its team before investing.

- Technical risks: DeFi projects often involve complex technical systems, and there is always the risk that something could go wrong. For example, a bug in the code could cause the project to fail, or a security breach could lead to the loss of funds.

- Competition: The DeFi space is highly competitive, and new projects are constantly emerging. This means that there is always the risk that a newer, better project could come along and make your investment obsolete.

Before investing in DeFi projects, it’s essential to be aware of these risks and think about them carefully.